By

Ever since Larry Wilkewitz retired more than 20 years ago from a wood products company, he’s had a commercial Medicare Advantage plan from the insurer Humana.

But two years ago, he heard about Peak Health, a new Advantage plan started by the West Virginia University Health System, where his doctors practice. It was cheaper and offered more personal attention, plus extras such as an allowance for over-the-counter pharmacy items. Those benefits are more important than ever, he said, as he’s treated for cancer.

“I decided to give it a shot,” said Wilkewitz, 79. “If I didn’t like it, I could go back to Humana or whatever after a year.” He’s sticking with Peak Health. Members of Medicare Advantage plans, a privately run alternative to the government’s Medicare program, can change plans through the end of March.

…Although hospital-owned plans are only a sliver of the Medicare Advantage market, their enrollment continues to grow, reflecting the overall increase in Advantage members. Of the 62.8 million Medicare beneficiaries eligible to join Advantage plans, 54% signed up last year, according to KFF, the health information nonprofit that includes KFF Health News. While the number of Advantage plans owned by hospital systems is relatively stable, Mass General Brigham in Boston and others are expanding their service areas and types of plan offerings.

… Medicare Advantage plans usually restrict their members to a network of doctors, hospitals, and other clinicians that have contracts with the plans to serve them. But if hospitals and plans can’t agree to renew those contracts, or when disputes flare up — often spurred by payment delays, denials, or burdensome prior authorization rules — the health care providers can drop out. These break-ups, plus planned terminations and service area cuts, forced more than 3.7 million Medicare Advantage enrollees to make a tough choice last year: find new insurance for 2026 that their doctors accept or, if possible, keep their plan but find new doctors.[Continued on KFF Health News, US News & World Report, Modern Healthcare, Medpage Today, and Fierce Health.]

Other Advantage members who lose providers are not as lucky. Although disputes between health systems and insurers happen all the time, members are usually locked into their plans for the year and restricted to a network of providers, even if that network shrinks. Unless members qualify for what’s called a

Other Advantage members who lose providers are not as lucky. Although disputes between health systems and insurers happen all the time, members are usually locked into their plans for the year and restricted to a network of providers, even if that network shrinks. Unless members qualify for what’s called a

That means even for the savviest shoppers it will be a challenge to figure out which plans offer the new benefits and who qualifies for them.

That means even for the savviest shoppers it will be a challenge to figure out which plans offer the new benefits and who qualifies for them. For years, most pharmacists couldn’t give customers even a clue about an easy way to save money on prescription drugs. But the restraints are coming off.

For years, most pharmacists couldn’t give customers even a clue about an easy way to save money on prescription drugs. But the restraints are coming off.

and

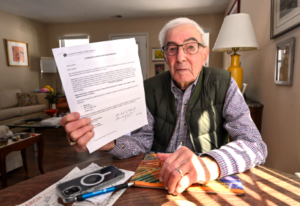

and  noticed an uptick in mail solicitations from health insurance companies, which can mean only one thing: It’s time for the annual Medicare open enrollment.

noticed an uptick in mail solicitations from health insurance companies, which can mean only one thing: It’s time for the annual Medicare open enrollment. nis, acting director of the Medicare Enrollment and Appeals Group at the Centers for Medicare & Medicaid Services.

nis, acting director of the Medicare Enrollment and Appeals Group at the Centers for Medicare & Medicaid Services.

period for these private drug and Advantage plans for 2016 starts Thursday and runs through Dec. 7.

period for these private drug and Advantage plans for 2016 starts Thursday and runs through Dec. 7.