By Susan Jaffe | KAISER HEALTH NEWS | March 13, 2017 |This story also ran in

Under a new federal law, hospitals across the country must now alert Medicare patients when they are getting observation care and why they were not admitted — even if they stay in the hospital a few nights. For years, seniors often found out only when they got

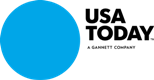

Hospitals must complete this notice and give it to Medicare observation patients.

surprise bills for the services Medicare doesn’t cover for observation patients, including some drugs and expensive nursing home care.

The notice may cushion the shock but probably not settle the issue.

When patients are too sick to go home but not sick enough to be admitted, observation care gives doctors time to figure out what’s wrong. It is considered an outpatient service, like a doctor’s visit. Unless their care falls under a new Medicare bundled-payment category, observation patients pay a share of the cost of each test, treatment or other services. And if they need nursing home care to recover their strength, Medicare won’t pay for it because that coverage requires a prior hospital admission of at least three consecutive days.

Observation time doesn’t count.

“Letting you know would help, that’s for sure,” said Suzanne Mitchell, of Walnut Creek, Calif. When her 94-year-old husband fell and was taken to a hospital last September, she was told he would be admitted. It was only after seven days of hospitalization that she learned he had been an observation patient. He was due to leave the next day and enter a nursing home, which Medicare would not cover. She still doesn’t know why.

“If I had known [he was in observation care], I would have been on it like a tiger because I knew the consequences

This KHN article also ran in The Philadelphia Inquirer.

by then, and I would have done everything I could to insist that they change that outpatient/inpatient,” said Mitchell, a retired respiratory therapist. “I have never, to this day, been able to have anybody give me the written policy the hospital goes by to decide.” Her husband was hospitalized two more times and died in December. His nursing home sent a bill for nearly $7,000 that she has not yet paid. [Continued at Kaiser Health News and USA Today] …

and

and  noticed an uptick in mail solicitations from health insurance companies, which can mean only one thing: It’s time for the annual Medicare open enrollment.

noticed an uptick in mail solicitations from health insurance companies, which can mean only one thing: It’s time for the annual Medicare open enrollment.

reschool teacher who lives in Kingsley Manor, a retirement community in Los Angeles. “I didn’t know what I was going to do about dental care.”

reschool teacher who lives in Kingsley Manor, a retirement community in Los Angeles. “I didn’t know what I was going to do about dental care.”

nis, acting director of the Medicare Enrollment and Appeals Group at the Centers for Medicare & Medicaid Services.

nis, acting director of the Medicare Enrollment and Appeals Group at the Centers for Medicare & Medicaid Services.  l their marketplace policies.

l their marketplace policies.

was a response to complaints from Medicare patients who were surprised to learn that although they had spent a few days in the hospital, they were there for observation and were not admitted. Observation patients are considered too sick to go home yet not sick enough to be admitted. They may pay higher charges than admitted patients and do not qualify for Medicare’s nursing home coverage.

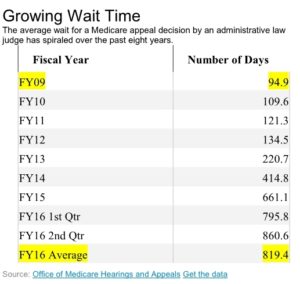

was a response to complaints from Medicare patients who were surprised to learn that although they had spent a few days in the hospital, they were there for observation and were not admitted. Observation patients are considered too sick to go home yet not sick enough to be admitted. They may pay higher charges than admitted patients and do not qualify for Medicare’s nursing home coverage. challenging denied claims continues to spiral, increasing the backlog of cases and delaying many decisions well beyond the timeframes set by law, according to a government study released Thursday.

challenging denied claims continues to spiral, increasing the backlog of cases and delaying many decisions well beyond the timeframes set by law, according to a government study released Thursday.

Looking for ways to save money and improve care, Medicare officials are returning to an old-fashioned idea: house calls.

Looking for ways to save money and improve care, Medicare officials are returning to an old-fashioned idea: house calls.

fractured hips and head injuries to irreversible calamities that can lead to death.

fractured hips and head injuries to irreversible calamities that can lead to death.