By ,

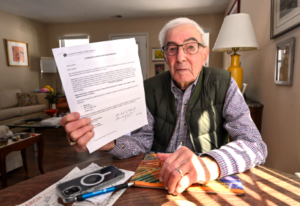

Bart Klion (Hans Pennink for KFF Health News)

Bart Klion, 95, and his wife, Barbara, faced a tough choice in January: The upstate New York couple learned that this year they could keep either their private, Medicare Advantage insurance plan — or their doctors at Saratoga Hospital.

The Albany Medical Center system, which includes their hospital, is leaving the Klions’ Humana plan — or, depending on which side is talking, the other way around. The breakup threatened to cut the couple’s lifeline to cope with serious chronic health conditions.

Klion refused to pick the lesser of two bad options without a fight.

..With rare exceptions, Advantage members are locked into their plans for the rest of the year — while health providers may leave at any time. …But a few years ago, CMS created an escape hatch by expanding special enrollment periods, or SEPs, which allow for “exceptional circumstances.” Beneficiaries who qualify can request SEPs to change plans or return to original Medicare. [Continued on KFF Health News]…