By

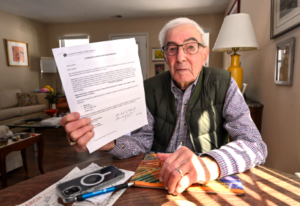

Along with the occasional aches and pains, growing older can bring surprise setbacks and serious diseases. Longtime relationships with doctors people trust often make even bad news more tolerable. Losing that support — especially during a health crisis — can be terrifying. That’s why little-known federal requirements are supposed to protect people with privately run Medicare Advantage coverage when contract disputes lead their health care providers and insurers to part ways.

But government documents obtained by KFF Health News show the agency overseeing Medicare Advantage does little to enforce long-standing rules intended to ensure about 35 million plan members can see doctors in the first place.

In response to a Freedom of Information Act request covering the past decade, the Centers for Medicare & Medicaid Services produced letters it sent to only five insurers from 2016 to 2022 after seven of their plans failed to meet provider network adequacy requirements — lapses that could, in some cases, harm patient care. [Continued on KFF Health News, CBS News, US News & World Report and MedpageToday.]…

as people who have qualified for Medicare due to a disability but chose to use marketplace plans.

as people who have qualified for Medicare due to a disability but chose to use marketplace plans.