By

Along with the occasional aches and pains, growing older can bring surprise setbacks and serious diseases. Longtime relationships with doctors people trust often make even bad news more tolerable. Losing that support — especially during a health crisis — can be terrifying. That’s why little-known federal requirements are supposed to protect people with privately run Medicare Advantage coverage when contract disputes lead their health care providers and insurers to part ways.

But government documents obtained by KFF Health News show the agency overseeing Medicare Advantage does little to enforce long-standing rules intended to ensure about 35 million plan members can see doctors in the first place.

In response to a Freedom of Information Act request covering the past decade, the Centers for Medicare & Medicaid Services produced letters it sent to only five insurers from 2016 to 2022 after seven of their plans failed to meet provider network adequacy requirements — lapses that could, in some cases, harm patient care. [Continued on KFF Health News, CBS News, US News & World Report and MedpageToday.]…

The Jan. 25 ruling, which came in response to a 2011 class-action lawsuit eventually joined by 14 beneficiaries against the Department of Health and Human Services, will guarantee p

The Jan. 25 ruling, which came in response to a 2011 class-action lawsuit eventually joined by 14 beneficiaries against the Department of Health and Human Services, will guarantee p

When Christine Williams began working as a nurse practitioner some forty years ago in

When Christine Williams began working as a nurse practitioner some forty years ago in

That means even for the savviest shoppers it will be a challenge to figure out which plans offer the new benefits and who qualifies for them.

That means even for the savviest shoppers it will be a challenge to figure out which plans offer the new benefits and who qualifies for them.

nth, each submitted ideas to the judge, who will decide — possibly within the next few months — what measures should be taken.

nth, each submitted ideas to the judge, who will decide — possibly within the next few months — what measures should be taken.

reschool teacher who lives in Kingsley Manor, a retirement community in Los Angeles. “I didn’t know what I was going to do about dental care.”

reschool teacher who lives in Kingsley Manor, a retirement community in Los Angeles. “I didn’t know what I was going to do about dental care.”

nis, acting director of the Medicare Enrollment and Appeals Group at the Centers for Medicare & Medicaid Services.

nis, acting director of the Medicare Enrollment and Appeals Group at the Centers for Medicare & Medicaid Services.

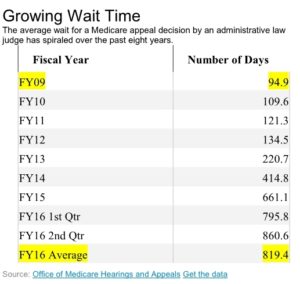

challenging denied claims continues to spiral, increasing the backlog of cases and delaying many decisions well beyond the timeframes set by law, according to a government study released Thursday.

challenging denied claims continues to spiral, increasing the backlog of cases and delaying many decisions well beyond the timeframes set by law, according to a government study released Thursday.