Category: Medicare costs

Biden Plan to Save Medicare Patients Money on Drugs Risks Empty Shelves, Pharmacists Say

-

From left, pharmacists Brent Talley of North Carolina, Scott Pace of Arkansas, and Clint Hopkins of California. (ELIZABETH TALLEY; KORI GORDON; JOEL HOCKMAN)

By Susan Jaffe | KFF Health News | June 11, 2024

Dodging the Medicare Enrollment Deadline Can Be Costly

By ,

Angela M. Du Bois, a retired software tester in Durham, North Carolina, wasn’t looking to replace her UnitedHealthcare Medicare Advantage plan. She wasn’t concerned as the Dec. 7 deadline approached for choosing another of the privately run health insurance alternatives to original Medicare.

But then something caught her attention: When she went to her doctor last month, she learned that the doctor and the hospital where she works will not accept her insurance next year.

Faced with either finding a new doctor or finding a new plan, Du Bois said the decision was easy. “I’m sticking with her because she knows everything about me,” she said of her doctor, whom she’s been seeing for more than a decade.

Du Bois isn’t the only one tuning out when commercials about the open enrollment deadline flood the airwaves each year — even though there could be good reasons to shop around. But sifting through the offerings has become such an ordeal that few people want to repeat it. Avoidance is so rampant that only 10% of beneficiaries switched Medicare Advantage plans in 2019.

Once open enrollment ends, there are limited options for a do-over…. [Continued on Kaiser Health News and NPR]…

US pharmaceutical companies sue to halt cuts in drug prices

Volume 402, Issue 10399

Volume 402, Issue 10399

29 July 2023

WORLD REPORT Medicare will soon be able to negotiate some drug prices to reduce costs for patients and taxpayers. Susan Jaffe reports from Washington, DC.

The first set of ten drugs subject to price negotiations by the US Medicare programme will be unveiled on Sept 1, 2023, but some pharmaceutical companies and their allies are not waiting to find out which products will be on the list. So far, four manufacturers and two trade associations are suing to stop the process before it begins. [Continued here.]

…

Medicare considers expanding dental benefits for certain medical conditions

Proposed changes in Medicare rules could soon pave the way for a significant expansion in Medicare-covered dental services, while falling short of the comprehensive benefits that many Democratic lawmakers have advocated.

That’s because, under current law, Medicare can pay for limited dental care only if it is medically necessary to safely treat another covered medical condition. In July, officials proposed adding conditions that qualify and sought public comment. Any changes could be announced in November and take effect as soon as January. The review by the Centers for Medicare & Medicaid Services follows an unsuccessful effort by congressional Democrats to pass comprehensive Medicare dental coverage for all beneficiaries, a move that would require changes in federal law. As defeat appeared imminent, consumer and seniors’ advocacy groups along with dozens of lawmakers urged CMS to take independent action. [Continued on Kaiser Health News and CNN]

…Health organisations welcome US climate crisis law

Volume 400, Issue 10354

Volume 400, Issue 10354

3 September 2022

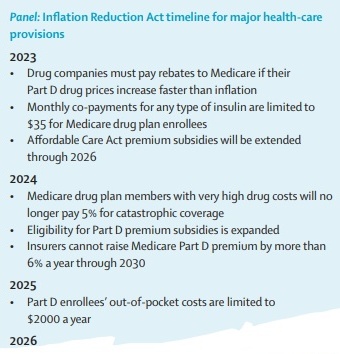

WORLD REPORT The recently passed Inflation Reduction Act will provide billions of dollars of incentives to reduce greenhouse gas emissions. Susan Jaffe reports.

There are no emission limits or pollution penalties in the landmark Inflation Reduction Act that Congress approved in August. Instead of forcing cuts, the climate change and healthcare law provides US$370 billion worth of incentives to ratchet down the planet-warming greenhouse gases from fossil fuels that have caused record-breaking heat waves, wild fires, droughts, and floods. …The law provides $60 billion for communities that have been disproportionately affected by toxic hazards and the consequences of climate change. [Continued here.]

…US Congress lets Medicare negotiate lower drug prices

Volume 400, Issue 10352

Volume 400, Issue 10352

20 August 2022

WORLD REPORT A new law also targets climate change in a major victory for Democrats and President Joe Biden. Susan Jaffe reports from Washington, DC.

Medicare Surprise: Drug Plan Prices Touted During Open Enrollment Can Rise Within a Month

By Susan Jaffe | Kaiser Health News | May 3, 2022 | This KHN story also ran on

… Medicare covers new Alzheimer’s drug, but there is a catch

Volume 399, Issue 10335

Volume 399, Issue 10335

23 April 2022

WORLD REPORT The federal health plan for older Americans will pay for the controversial new drug aducanumab only for patients participating in clinical trials. Susan Jaffe reports.

…

Medicare Patients Win the Right to Appeal Gap in Nursing Home Coverage

Medicare’s Open Enrollment Is Open Season for Scammers

By Susan Jaffe | Kaiser Health News | November 11, 2021 | This KHN story also ran in The Washington Post.

In response, the Centers for Medicare and Medicaid Services has threatened to penalize private insurance companies selling Medicare Advantage and drug plans if they or agents working on their behalf mislead consumers. The agency has also revised rules making it easier for beneficiaries to escape plans they didn’t sign up for or enrolled in only to discover promised benefits didn’t exist or they couldn’t see their providers.

The problems are especially prevalent during Medicare’s open-enrollment period, which began Oct. 15 and runs through Dec. 7. A common trap begins with a phone call like the one Linda Heimer, an Iowa resident, received in October. [Full story in The Washington Post and Kaiser Health News.]

3 States Limit Nursing Home Profits in Bid to Improve Care

“If they choose to rely on public dollars to deliver care, they take on a greater responsibility,” says New York Assemblyman Ron Kim. “It’s not like running a hotel.”

By Susan Jaffe | KAISER HEALTH NEWS | October 25, 2021 | This story also ran on

Nursing homes receive billions of taxpayers’ dollars every year to care for chronically ill frail elders, but until now, there was no guarantee that’s how the money would be spent.

Massachusetts, New Jersey and New York are taking unprecedented steps to ensure they get what they pay for, ![]() after the devastating impact of covid-19 exposed problems with staffing and infection control in nursing homes. The states have set requirements for how much nursing homes

after the devastating impact of covid-19 exposed problems with staffing and infection control in nursing homes. The states have set requirements for how much nursing homes  must spend on residents’ direct care and imposed limits on what they can spend elsewhere, including administrative expenses, executive salaries and advertising and even how much they can pocket as profit. …With this strategy, advocates believe, residents won’t be shortchanged on care, and violations of federal quality standards should decrease because money will be required to be spent on residents’ needs. At least that’s the theory. [Continued on Kaiser Health News, Fortune, NBC News, Yahoo Finance, and Chicago Sun-Times]…

must spend on residents’ direct care and imposed limits on what they can spend elsewhere, including administrative expenses, executive salaries and advertising and even how much they can pocket as profit. …With this strategy, advocates believe, residents won’t be shortchanged on care, and violations of federal quality standards should decrease because money will be required to be spent on residents’ needs. At least that’s the theory. [Continued on Kaiser Health News, Fortune, NBC News, Yahoo Finance, and Chicago Sun-Times]…

US FDA defends approval of Alzheimer’s disease drug

Volume 398, Issue 10294

Volume 398, Issue 10294

3 July 2021

WORLD REPORT An avalanche of criticism has forced the US Food and Drug Administration to defend its decision to grant accelerated approval for aducanumab, the first new Alzheimer’s disease treatment in two decades. “It will be a very long time before we ever figure out whether or not this drug really works”, said Aaron Kesselheim, professor of medicine at Brigham and Women’s Hospital and Harvard Medical School who resigned in protest from an FDA advisory panel that recommended against approval.[Continued here.]

…

US drug importation plan hits snag

Volume 397, Issue 10291

12 June 2021

WORLD REPORT The Biden administration says it has “no timeline” for deciding if states can import cheap drugs from Canada.

President Joe Biden’s administration said last week that it won’t decide whether to allow states to import drugs from Canada anytime soon, if ever. Biden supported drug importation during the presidential campaign, as did his opponent, Donald Trump, to mitigate sky-rocketing drug costs in the USA. Americans pay more per capita for prescription drugs than any other country…. [Continued here.]

…

Under New Cost-Cutting Medicare Rule, Same Surgery, Same Place, Different Bill

By Susan Jaffe | Kaiser Health News | March 21, 2021 | This KHN story also ran in The Washington Post

For years, Medicare officials considered some su rgeries so risky for older adults that that the insurance program would cover the procedures only for patients admitted to the hospital. Under a new Medicare policy that took effect this year, these operations can be provided to patients who are not admitted. But patients still have to go to the hospital. The change saves Medicare money while patients can pay a larger share of the bill — for the same surgery at the same hospital. [Full story in The Washington Post and Kaiser Health News.]

rgeries so risky for older adults that that the insurance program would cover the procedures only for patients admitted to the hospital. Under a new Medicare policy that took effect this year, these operations can be provided to patients who are not admitted. But patients still have to go to the hospital. The change saves Medicare money while patients can pay a larger share of the bill — for the same surgery at the same hospital. [Full story in The Washington Post and Kaiser Health News.]

… House Committee Approves Bill to Ease Medicare Part B Enrollment

Seniors would be notified about eligibility to avoid late fees, coverage gap

Congress Considers Bill to Address Medicare Late Penalties, Coverage Gap

Current enrollment rules can leave late enrollees liable for doc visits Medicare usually covers

Legislation that would fix these problems was one of the bills discussed at a hearing held by the House Energy & Commerce Health Subcommittee…. Although the panel focused on how the bipartisan Beneficiary Enrollment Notification and Eligibility Simplification (BENES) Act impacts Medicare patients, it also affects their physicians. [Continued here and PDF here]

As Medicare Enrollment Nears, Popular Price Comparison Tool Is Missing

By Susan Jaffe | Kaiser Health News | October 8, 2019 | This article also ran in the![]()

Millions of older adults can start signing up next week for private policies offering Medicare drug and medical  coverage for 2020. But many risk wasting money and even jeopardizing their health ca

coverage for 2020. But many risk wasting money and even jeopardizing their health ca![]() re due to changes in Medicare’s plan finder, its most popular website.

re due to changes in Medicare’s plan finder, its most popular website.

For more than a decade, beneficiaries used the plan finder to compare dozens of Medicare policies offered by competing insurance companies and get a list of their options. Yet after a website redesign six weeks ago, the search results are missing crucial details: How much will you pay out-of-pocket? And which plan offers the best value? [Continued at Kaiser Health News, San Francisco![]()

Class-Action Lawsuit Seeks To Let Medicare Patients Appeal Gap in Nursing Home Coverage

By Susan Jaffe | Kaiser Health News | August 12, 2019 | This KHN story also ran on Salon and Next Avenue

Medicare paid for Betty Gordon’s knee replacement surgery in March, but the 72-year-old former high school teacher needed a nursing home stay and care at home to recover.

![]()

Yet Medicare wouldn’t pay for that. So Gordon is stuck with a $7,000 bill she can’t afford — and, as if that were not bad enough, she can’t appeal.

The reasons Medicare won’t pay have frustrated the Rhode Island woman and many others trapped in the maze of regulations surrounding something called “observation care.”

Patients, like Gordon, receive observation care in the hospital when their doctors think they are too sick to go home but not sick enough to be admitted. They stay overnight or longer, usually in regular hospital rooms, getting some of the same services and treatment (often for the same problems) as an admitted patient….

(Photo courtesy of Betty Gordon)

But observation care is considered an outpatient service under Medicare rules, like a doctor’s appointment or a lab test. Observation patients may have to pay a larger share of the hospital bill than if they were officially admitted to the hospital.Medicare’s nursing home benefit is available only to those admitted to the hospital for three consecutive days. Gordon spent three days in the hospital after her surgery, but because she was getting observation care, that time didn’t count.

There’s another twist: Patients might want to file an appeal, as they can with many other Medicare decisions. But that is not allowed if the dispute involves observation care.

Monday, a trial begins in federal court in Hartford, Conn., where patients who were denied Medicare’s nursing home benefit are hoping to force the government to eliminate that exception. A victory would clear the way for appeals from hundreds of thousands of people. [Continued at Kaiser Health News, Next Avenue or Salon]

…Social Security Error Jeopardizes Medicare Coverage For 250,000 Seniors

By Susan Jaffe | Kaiser Health News | June 6, 2019 | This KHN story also ran on

At least a quarter of a million Medicare beneficiaries may receive bills for as many as five months of premiums they thought they already paid.

But they shouldn’t toss the letter in the garbage. It’s not a scam or a mistake.

Because of what the Social Security Administration calls “a processing error” that occurred in January, it did not deduct premiums from some seniors’ Social Security checks and it didn’t pay the insurance plans.

[Continued at Kaiser Health News or NPR ]

…Home Health Care Providers Struggle With State Laws And Medicare Rules As Demand Rises

“We can send prescriptions to the pharmacy, including [for] narcotics,” says Marie Grosh, a geriatric advanced practice nurse practitioner and the owner of a medical house calls practice in a Cleveland suburb. “We can order lab work, x-rays, ultrasounds, EKGs [electrocardiagrams]; interpret them; and treat patients based on that. But we’re just not allowed to order home care—which is absurd.”

By SUSAN JAFFE | Health Affairs | June 2019 | Volume 38, Number 8

When Christine Williams began working as a nurse practitioner some forty years ago in Detroit, Michigan, older adults who couldn’t manage on their own and had no family nearby and no doctor willing to make house calls had few options besides winding up in a nursing home.

When Christine Williams began working as a nurse practitioner some forty years ago in Detroit, Michigan, older adults who couldn’t manage on their own and had no family nearby and no doctor willing to make house calls had few options besides winding up in a nursing home.

Not anymore.

Home check: Nurse practitioner Marie Grosh visits Leroy Zacharias at his home in a Cleveland suburb, He has Parkinson disease, and Grosh says he would be living in a nursing home if he couldn’t get medical care at home. (Photo by Lynn Ischay.)

“The move towards keeping seniors in their homes is a fast-galloping horse here,” says Williams, who settled in Cleveland, Ohio, more than a decade ago. “We don’t have space for them in long-term care [facilities], they don’t want to be in long-term care, and states don’t want to pay for long-term care. And everybody wants to live at home.”

But despite the growing desire for in-home medical care for older adults from nearly all quarters, seniors’ advocates and home health professionals claim that rules set by the Centers for Medicare and Medicaid Services (CMS) along with state regulations have created an obstacle course for the very providers best positioned—and sometimes the only option—to offer that care. [Continued here] …

Trumpeted New Medicare Advantage Benefits Will Be Hard For Seniors To Find

By Susan Jaffe | Kaiser Health News | November 9, 2018 | This KHN story also ran on

For some older adults, private Medicare Advantage plans next year will offer a host of new benefits, such as transportation to medical appointments, home-delivered meals, wheelchair ramps, bathroom grab bars or air conditioners for asthma sufferers.

But the new benefits will not be widely available, and they won’t be easy to find.

Of the 3,700 plans across the country next year, only 273 in 21 states will offer at least one. About 7 percent of Advantage members — 1.5 million people — will have access, Medicare officials estimate.

That means even for the savviest shoppers it will be a challenge to figure out which plans offer the new benefits and who qualifies for them.

That means even for the savviest shoppers it will be a challenge to figure out which plans offer the new benefits and who qualifies for them.

Medicare officials have touted the expansion as historic and an innovative way to keep seniors healthy and independent. Despite that enthusiasm, a full listing of the new services is not available on the web-based “Medicare Plan Finder,” the government tool used by beneficiaries, counselors and insurance agents to sort through dozens of plan options. [Continued at Kaiser Health News, NPR and CNN]…

No More Secrets: Congress Bans Pharmacist ‘Gag Orders’ On Drug Prices

Update: After this article was posted Oct. 10th, the President signed the legislation into law later that day.

By Susan Jaffe | Kaiser Health News | October 10, 2018 | This KHN story also ran on

For years, most pharmacists couldn’t give customers even a clue about an easy way to save money on prescription drugs. But the restraints are coming off.

For years, most pharmacists couldn’t give customers even a clue about an easy way to save money on prescription drugs. But the restraints are coming off.

When the cash price for a prescription is less than what you would pay using your insurance plan, pharmacists will no longer have to keep that a secret.

…But there’s a catch: Under the new legislation, pharmacists will not be required to tell patients about the lower cost option. If they don’t, it’s up to the customer to ask. [Continued at Kaiser Health News and at NBC News]

…New Medicare Advantage Tool To Lower Drug Prices Puts Crimp In Patients’ Choices

Some physicians and patient advocates are concerned that the pursuit of lower Part B drug prices could endanger very sick Medicare Advantage patients if they can’t be treated promptly with the medicine that was their doctor’s first choice.

By Susan Jaffe | Kaiser Health News | September 17, 2018 | This KHN story also ran on

Starting next year, Medicare Advantage plans will be able to add restrictions on expensive, injectable drugs administered by doctors to treat cancer, rheumatoid arthritis, macular degeneration and other serious diseases.

Under the new rules from Medicare, these private Medicare insurance plans could require patients to try cheaper drugs first. If those are not  effective, then the patients could receive the more expensive medication prescribed by their doctors.

effective, then the patients could receive the more expensive medication prescribed by their doctors.

Insurers use such “step therapy” to control drug costs in the employer-based insurance market as well as in Medicare’s stand-alone Part D prescription drug benefit, which generally covers medicine purchased at retail pharmacies or through the mail. The new option allows the private Medicare plans — an alternative to traditional, government-run Medicare — to extend that cost-control strategy to these physician-administered drugs.

…Critics of the new policy, part of the administration’s efforts to fulfill President Donald Trump’s promise to cut drug prices, say it lacks some crucial details, including how to determine when a less expensive drug isn’t effective. [Continued at Kaiser Health News and NPR]

…

Looking For Lower Medicare Drug Costs? Ask Your Pharmacist For The Cash Price.

Sometimes a drug plan’s copay is higher than the cash, but insurers’ “gag orders” keep pharmacists from telling Medicare beneficiaries. A little-known Medicare rule requires pharmacists to divulge the lower cash price if patients ask.

By Susan Jaffe | Kaiser Health News | May 30, 2018 | This KHN story also ran on

As part of President Donald Trump’s blueprint to bring down prescription costs, Medicare officials have warned insurers that “gag orders”

Scott Olson/Getty Images

keeping pharmacists from alerting seniors that they could save money by paying cash — rather than using their insurance — are “unacceptable and contrary” to the government’s effort to promote price transparency.

But the agency stopped short of requiring insurers to lift such restrictions on pharmacists.

That doesn’t mean people with Medicare drug coverage are destined to overpay for prescriptions. Under a little-known Medicare rule, they can pay a lower cash price for prescriptions instead of using their insurance. But first, they must ask the pharmacist about that option…. [Continued at Kaiser Health News, NPR and CNN Money]…

The Jan. 25 ruling, which came in response to a 2011 class-action lawsuit eventually joined by 14 beneficiaries against the Department of Health and Human Services, will guarantee p

The Jan. 25 ruling, which came in response to a 2011 class-action lawsuit eventually joined by 14 beneficiaries against the Department of Health and Human Services, will guarantee p